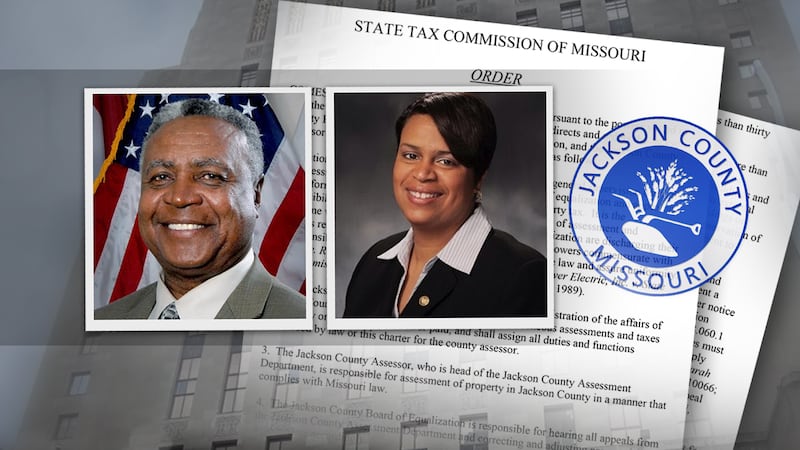

Property Assessments: Jackson County agrees to comply with State order

KANSAS CITY, Mo. (KCTV) - Jackson County confirmed with the Missouri State Tax Commission that it will comply with the STC’s order issued last week.

The order, signed on May 22, concerns the 2025 Jackson County property tax assessment.

It applies to properties that saw an increase of more than 15% from 2022 to 2023. The county will add a maximum 15% to the 2022 value to get the 2023 value, which will become the 2025 value.

“It’s consistent with what I think is keeping us from issuing an illegal assessment in 2025,” said Sean Smith, Jackson County Legislator.

The order states that the county would go back to the 2022 assessment to get a baseline. Then, it would cap the increases for 2023 at 15% in most cases.

Then, for the 2025 assessment, that increase would again cap the increase at 15 percent in most cases.

While the county has agreed in writing to comply with this order, it’s still fighting the order pertaining to the 2023 assessment in court.

“It’s very good news for folks who had big increases in 2023 and 2024,” said Sean Smith, “if their bill was inflated in ‘23 and ‘24, then without this STC order, it was going to be inflated in ‘25 as well.

County legislator Sean Smith said this latest move is good news, but it’s not the full package.

For those who have appealed, Sean said you won’t get your money back, yet, they’re still fighting for that. But what it does, in the meantime, is hopefully reduce the 2025 tax bill.

“I was surprised that this actually happened,” said Preston Smith, a data analyst, “it’s the first time that Jackson County ever agreed to anything that made sense.”

Preston Smith said he’s skeptical about the sudden shift from the county agreeing to follow rules previously fought.

“You have to ask yourself, how come? You got the recall on Frank White...you got the special session starting next week in the legislature, and you got a tax issue that’s clouded over the stadium vote,” explained Preston.

While Preston agrees that this could be a positive shift, he worries the county could still backtrack.

“My concern is that they may come back on their word, I don’t think this is a done deal,” he said, “until those values are certified by the county and also the state, they’re open to change.”

KCTV5 reached out to the county istration for comment, but did not hear back as of Tuesday evening.

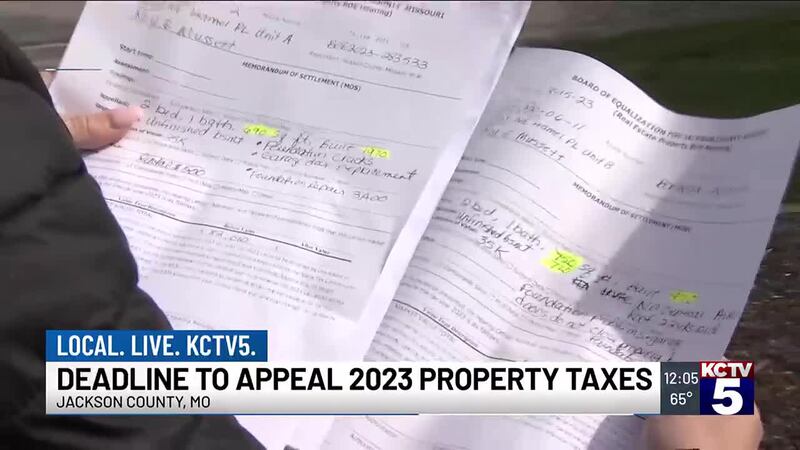

KCTV5 Investigates did numerous stories on the troubled assessment. Many homeowners told KCTV they feared losing their homes because they couldn’t pay the steep increases. Some saw their assessed values go up over 50 percent. More than 54,000 property owners filed appeals following the 2023 assessment.

Copyright 2025 KCTV. All rights reserved.