Missouri earthquake insurance rates skyrocket - why?

Missouri is the third-largest market, and prices vary across the state -- most out of homeowner budgets

ST. LOUIS, Mo. (First Alert 4) - Once, earthquake insurance was so common and cheap, agents just added it on to policies in southern Missouri, re Missouri Farm Bureau Agency Sales Manager Jason Ginder. But, because the prices have gone up so much -- that’s no longer the case.

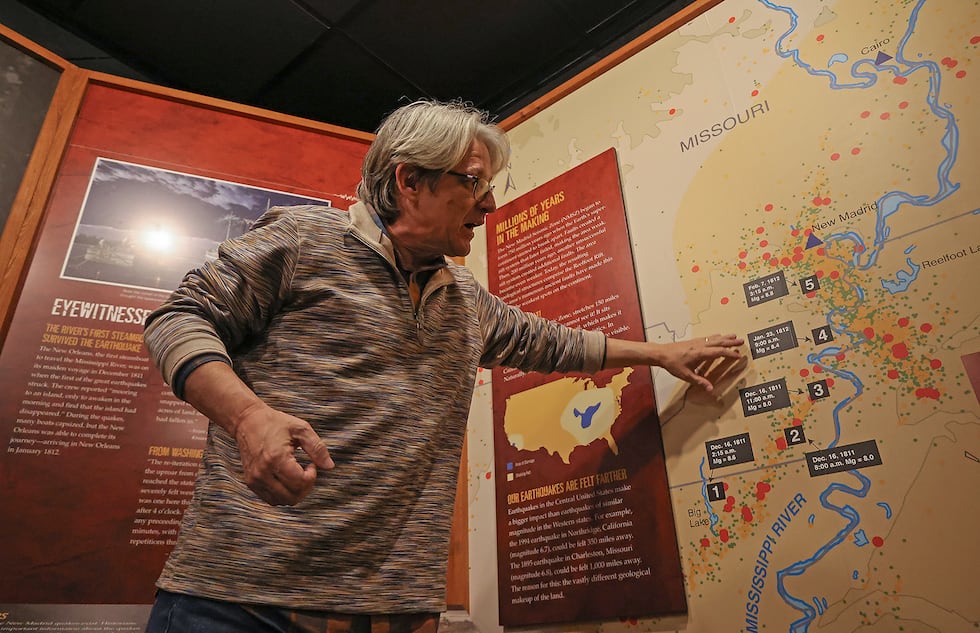

He works in New Madrid, a small town in southern Missouri that was home to the worst earthquake in Midwestern history. The impact of the storm was so severe it’s changed federal policy and is a haunting reminder of what could happen at any time.

Which is what insurance is supposed to help with -- but with prices so high -- many homeowners are opting out.

The Show Me State is the third-largest market for earthquake insurance in the U.S., right behind California and Washington, according to the Missouri Department of Insurance.

FEMA and other federal disaster experts estimate that if a major earthquake happened along the New Madrid Seismic Zone, (which takes it’s name from the town), it would probably be the worst natural disaster related economic loss in American history.

EARTHQUAKE ZONE

If you lived near New Madrid, Missouri in 2000, it would cost just $57 a year to insure your home against an earthquake. With seismic fault lines under your feet that could – and a few hundred years ago, did – decimate the area, that was a steal.

But today, insurance costs have become unaffordable for many. According to state data from 2023, it’s up to $569 a year.

The MDI says prices for earthquake insurance vary greatly, and the public doesn’t always understand the nuances.

For a $200,000 ranch home covering 2,500 square-feet with a shingle roof the average for Caruthersville (down in the Bootheel) was estimated at $2,134. That was in 2023.

That’s significantly higher than St. Louis at $398, and Kansas City at $206.

For that same home in 2024, the price for a in Caruthersville went up 7% from the year before, the MDI says.

In some areas of Missouri, the s are eight times as expensive as they were in the 2000s.

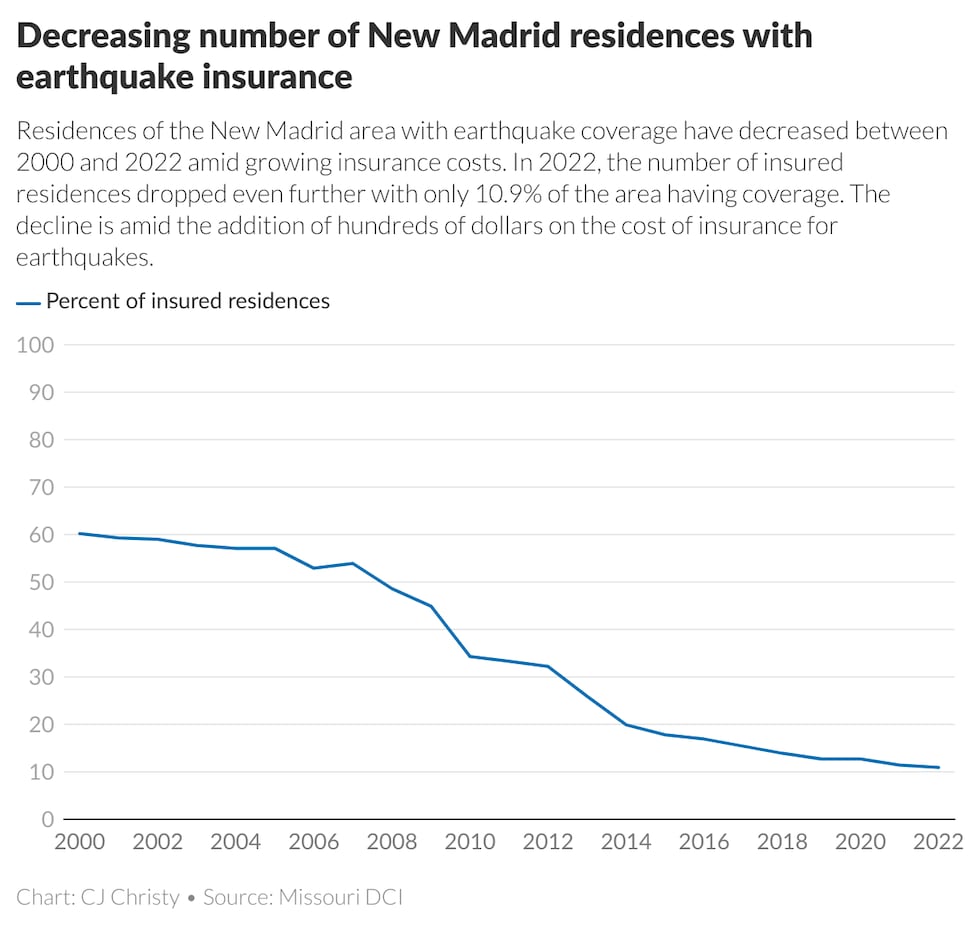

In the New Madrid area only about 11% of homes have earthquake coverage -- residents saying the high cost of insurance for a possible disaster is just too much.

It’s been over one hundred years since the last major earthquake, but prices have skyrocketed in the last couple of decades. Why?

HEAR THE IMPACTS

Buying insurance

If this all sounds a little daunting, thinking about how to buy insurance and where to find it - the MDI has created a cheatsheet.

This document from the experts at the state advise homeowners on why this insurance matters, and what potential challenges you may see in purchasing a policy.

It includes a list of available companies, prices, policy coverage and dismantles technical language.

Supply-side shocks

One cause is inflation. As the cost of construction rises, insurance companies need to not only increase their prices, but also increase the amount of money they have in reserve if they want to ensure they’ll be able to pay out claims. As the amount they think they’ll need rises, those costs usually get ed on to the consumer.

“They want to make sure that even if an earthquake — like in 100 years, or even in 200 years — happens, they can still stay solvent,” said Hong Li, an expert in actuarial science based at Canada’s University of Guelph.

But inflation isn’t the only cause — the price of earthquake insurance has outpaced inflation. Another cause is developments in how companies measure risk.

Insurance companies use actuarial science to quantify risk. That involves using mathematical and statistical models to determine the likelihood of different events. But catastrophes pose a difficult problem. The risk can be hard to quantify, especially in the case of earthquakes, where it’s not clear how soon or severe the next one will be. But scientific advancement has allowed them to paint a clearer picture.

“We have better scientific models, we have better ways of recording data, we probably have more sensitive equipment throughout the fault area, feeling the ground tremors,” said Michael R. Powers, a professor of economics and business at Tsinghua University in China.

As those models became more precise, Powers said insurance companies likely raised their prices to reflect the risk they were taking on.

In the early 2000s, around the time the state insurance department’s report said prices began rising, the United States Geological Survey updated its estimates for the possibility of an earthquake.

“The new forecasts estimate a 7 to 10 percent chance, in the next 50 years, of a repeat of a major earthquake like those that occurred in 1811-1812, which likely had magnitudes of between 7.5 and 8.0,” said a 2003 press release from the USGS. “There is a 25 to 40 percent chance, in a 50-year time span, of a magnitude 6.0 or greater earthquake.”

The press release goes on to describe that the agency was using new technology to predict the frequency of earthquakes and the forecast changed considerably since it was last estimated in 1985.

“(Companies) use government data,” Powers said. “They talk to government researchers to try to get estimates for the risks and parameters of their models.”

But if that was in 2003, why have prices continued to rise – and outpace inflation – since?

Li said a small change in cost or pricing can cause a loop that continues to drive up prices.

Here’s how it works. A small change in price will make some people drop their insurance. The people most likely to drop their insurance are people at the lowest risk. Now, the client pool has a higher proportion of high-risk clients, meaning that offering insurance is riskier. So, the insurance company raises prices to make sure they have enough money in reserves to remain solvent in the case of an earthquake – and the loop starts again.

Some companies have left the market, deciding it’s too risky to offer earthquake insurance at all. The Missouri Farm Bureau, for example, no longer offers its own earthquake insurance policy in New Madrid, and instead supplies it to its customers through third parties.

“We went with Lloyds of London, and they pulled out on us,” said Missouri Farm Bureau Agency Sales Manager Jason Ginder, who’s based in New Madrid. “It’s probably just due to the amount of risk, because if we do have a big earthquake, it’s going to affect St. Louis to Memphis, and there’s a lot of risk in that area.”

Died down demand

Shifting attitudes about the earthquake from consumers also play a role in the lack of coverage. As previously reported by the Columbia Missourian and KBIA, the next earthquake is far from being perceived as an imminent, existential threat by most town residents – it’s more of a back-of-the-mind worry, a fable or novelty. Only about 11% of residencies in the New Madrid region had earthquake insurance in 2021, down from over 60% in 2000.

“(Major earthquakes) don’t occur as frequently as they do with other places, and it’s been a long time since there’s been one that’s really scary, and I think that plays a huge role in the consumer perspective,” Powers said. “In other words, why should I buy earthquake insurance for my house if there hasn’t been a magnitude six earthquake in more than 100 years?”

Beyond the financial concerns, there’s a historical concern – no one in New Madrid today knows anyone who lived through the severe earthquakes of 1811. But they all either lived through or know people who lived through a major red herring regarding the fault in 1990.

Iben Browning, a self-proclaimed “climatologist,” predicted there would be a large earthquake in New Madrid on or around Dec. 3, 1990. Despite having no scientific basis, his prediction led to mass panic and media attention. Disaster officials struck on the opportunity to get people prepared, even if it meant stirring a panic.

“Even if he isn’t correct, he’s (Iben Browning) doing a great service for emergency preparedness, because people are finally listening,” the director of public safety in Sikeston, Mo. said in 1990, according to a U.S. Geological Survey report.

“Some state and local emergency management agencies, unsure about the legitimacy of the prediction, unwittingly gave it credibility by using it as an opportunity to promote earthquake preparedness,” Jill Stevens, the Seismic Resource Center Manager at Memphis State’s Center for Earthquake Research and Information said in a 1991 issue of the Natural Hazards Observer.

Leading up to the disaster, people in Missouri shelled out nearly $22 million on insurance policies, according to the USGS report.

“State Farm Insurance reported applications for coverage in Missouri to have been about 2,000 per day prior to Dec. 3, and about 50 per day afterwards,” the report reads.

Today, that paranoia is long gone. But efforts to increase insurance coverage want to harness that fear – but for preparation, not paranoia.

“Earthquakes don’t just happen in California,” an ad from the Missouri Department of Commerce and Insurance begins. “They can happen right here at any time and with no warning. The chance of a major earthquake in the next 50 years is as high as 40% and could cause up to $300 billion in damage.”

Brian Houston, a researcher at the University of Missouri focused on disaster communications, said it’s often necessary to strike fear to encourage action.

“Because people aren’t super concerned and super aware, more fear-arousing messaging is maybe what’s needed,” he said.

The second part of the ad informs viewers that most homeowners insurance policies don’t cover earthquakes.

“We found that many consumers aren’t aware that they are not covered by earthquake insurance because they thought it was part of their homeowners coverage,” department spokesperson Lori Croy said.

Croy added that part of the reason residents have that misconception is “not everyone has an insurance agent like the traditional ones that we used to have – some people research insurance for quotes online now.”

Local agents in Missouri, like Ginder with the Missouri Farm Bureau, said around 30% to 35% of his clients opt for earthquake insurance. That’s around three times the region’s average – but it used to be a lot more.

“When I first started, the rates were so low I didn’t even ask people, I just put it on their policy,” he said.

Croy said Missouri is a leader in using social media to get the message out about earthquake risk. The department touts its campaign as one of the reasons why insurance coverage rates increased to 11.5% in 2023 – which is about half a percent higher than the year before, but still slightly lower than the 2021 figure of 11.6%.

But no one the Missourian and KBIA spoke with in the New Madrid area, including the town’s mayor, Nick White, was familiar with the campaign. A presentation from the National Association of Insurance Commissioners in 2022 reported that only 23% of sampled residents had seen the campaign’s materials.

“Communicating about this type of topic is a journey, not an event,” Croy said.

While a campaign to inform people may be a step in the right direction, it doesn’t immediately address the elephant in the room — cost. That was many New Madrid residents’ main objection to earthquake insurance when asked. At the end of the day, you can’t scare people into buying something they can’t afford.

Correcting a “market failure”

Policy experts and officials have some ideas on how to bring costs down.

To solve the problems caused by the high cost of maintaining claims reserves, Li posited the state should create a fund of “last resort” where revenue is deposited over time in a special for when disaster strikes.

“I (can) use that money to subsidize insurance, or I can pay the money directly to people that are affected, or I can pay this money through commercial insurance companies to their customers,” Li said.

Letting taxpayers take on some of the long-term burden could act as a backstop for insurance companies.

“If there is a certain long-term in the background, then the insurance company might want to slowly, slowly, slowly reduce their ,” he said. “More people would start buying earthquake insurance again.”

Another proposal Li suggested would be to address the lack of suppliers – something he calls a “market failure” – by mandating insurance companies offer earthquake insurance if they want to continue doing business in the state.

That could provide for more consumer choice, lower prices and spread the risk of disaster across more companies.

California does something similar – all companies that provide homeowners insurance must also offer earthquake insurance.

But Missouri’s political climate is different from California’s.

Donnie Brown is the Republican state representative for New Madrid County and the town of New Madrid’s former mayor. While he’s concerned about the insurance coverage figures, he’s not surprised given the price. He also serves on the state’s seismic committee, which he said is looking into solutions to the coverage gap.

“I’m kind of waiting to see what that committee comes up with,” he said. “They’ve got a lot of experts, a lot of that travel around the world and study earthquakes, and so I’m kind of leaning on those guys, those experts, and hopefully they’ll come up with a solution out of that committee, and then we can pursue something legislatively.”

While Brown is skeptical of government involvement in the market, he said he’s open to ing suggestions from experts.

“Government’s supposed to be here to help our citizens,” Brown said. “I don’t know that we always make things better, but if we could do something like that, a tax break or something that would get people insured, I would look at that for sure.”

Still, Brown doesn’t think there’ll be the political will in both the state Senate and House to get a government solution ed. Brown’s counterpart in the state Senate, Republican Jason Bean, declined to comment.

“It doesn’t need to be out of sight, out of mind,” Brown said. “It’s something that we need to be thinking about and when we have opportunities, we need to make it better.”

This story is a product of the Mississippi River Basin Ag & Water Desk, an independent reporting network based at the University of Missouri in partnership with Report for America, with major funding from the Walton Family Foundation.

Copyright 2025 KMOV. All rights reserved.